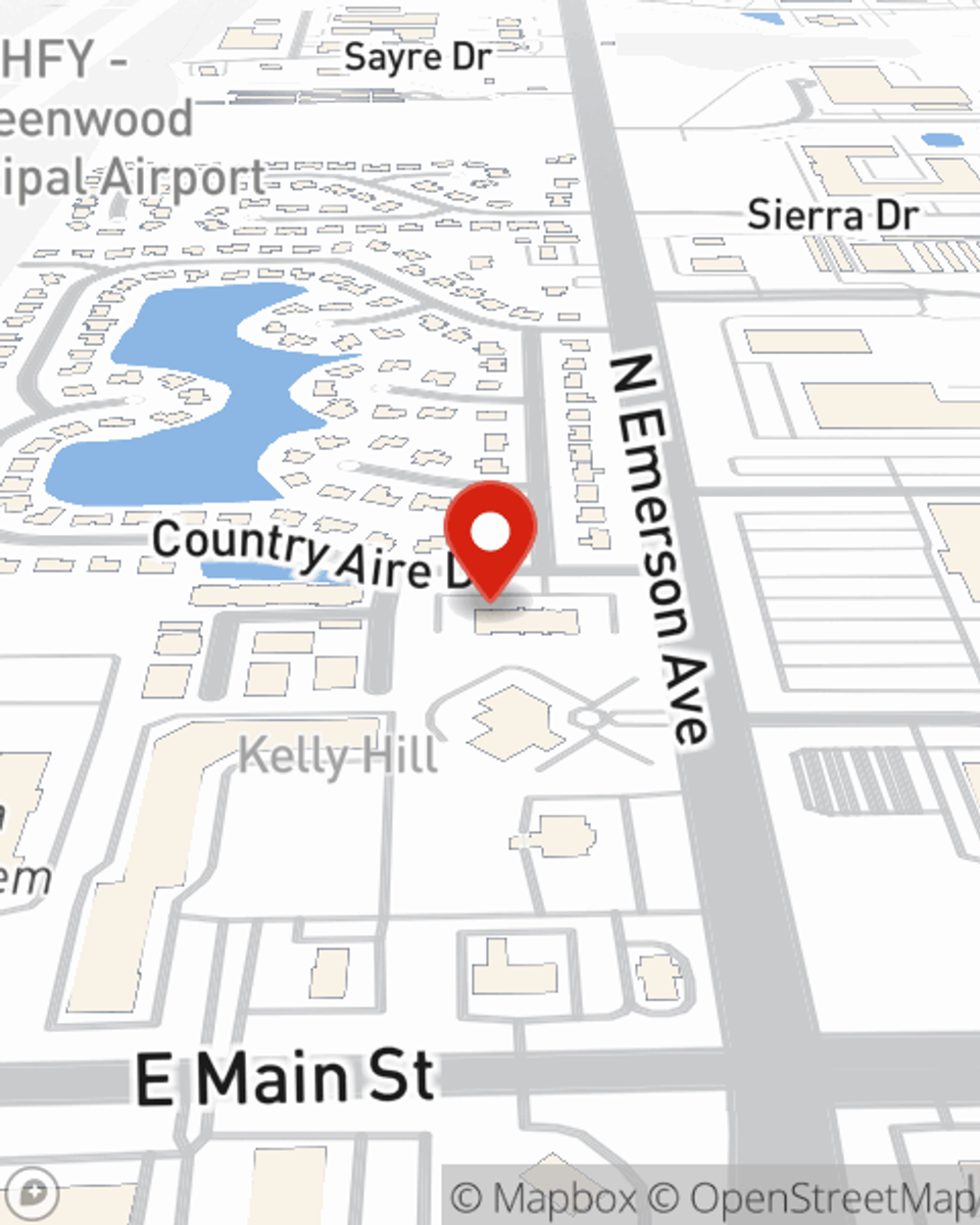

Life Insurance in and around Greenwood

Insurance that helps life's moments move on

Life happens. Don't wait.

Would you like to create a personalized life quote?

Check Out Life Insurance Options With State Farm

It may make you weary to contemplate when you pass away, but preparing for that day with life insurance is one of the most significant ways you can express love to the ones you hold dear.

Insurance that helps life's moments move on

Life happens. Don't wait.

Their Future Is Safe With State Farm

Having the right life insurance coverage can help loss be a bit less debilitating for the ones you hold dear and provide space to grieve. It can also help cover certain expenses like ongoing expenses, future savings and grocery bills.

Don’t let concerns about your future stress you out. Reach out to State Farm Agent Rob Bailey today and see the advantages of State Farm life insurance.

Have More Questions About Life Insurance?

Call Rob at (317) 882-1299 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.